Unlocking the Secrets of Manhattan Cap Rates: A Comprehensive Analysis

Manhattan Cap Rates: A Guiding Light

Investing in Manhattan’s premium real estate market requires a nuanced understanding of cap rates. These elusive numbers can make or break your investment strategy, swaying your decisions and ultimately determining your financial success or setback.

Unveiling the Problems in Greenland: A Comprehensive Analysis – Travel – Source traveltonorth.com

Empowering Investors with Comprehensive Insights

This article delves into the intricate world of Manhattan cap rates, unraveling their complexities and empowering investors with comprehensive insights. From historical trends to hidden secrets, we’ll cover every aspect to equip you with the knowledge you need to navigate this competitive market like a seasoned pro.

Understanding & Thriving in a Low Cap Rate Environment – Source vossreadvisors.com

A Personal Journey through Cap Rates

My first encounter with cap rates was a mixture of excitement and trepidation. As a budding real estate investor, I needed to grasp these enigmatic figures that held the key to unlocking Manhattan’s lucrative potential. With diligent research and the guidance of experienced mentors, I gradually peeled back the layers of complexity and gained an invaluable understanding.

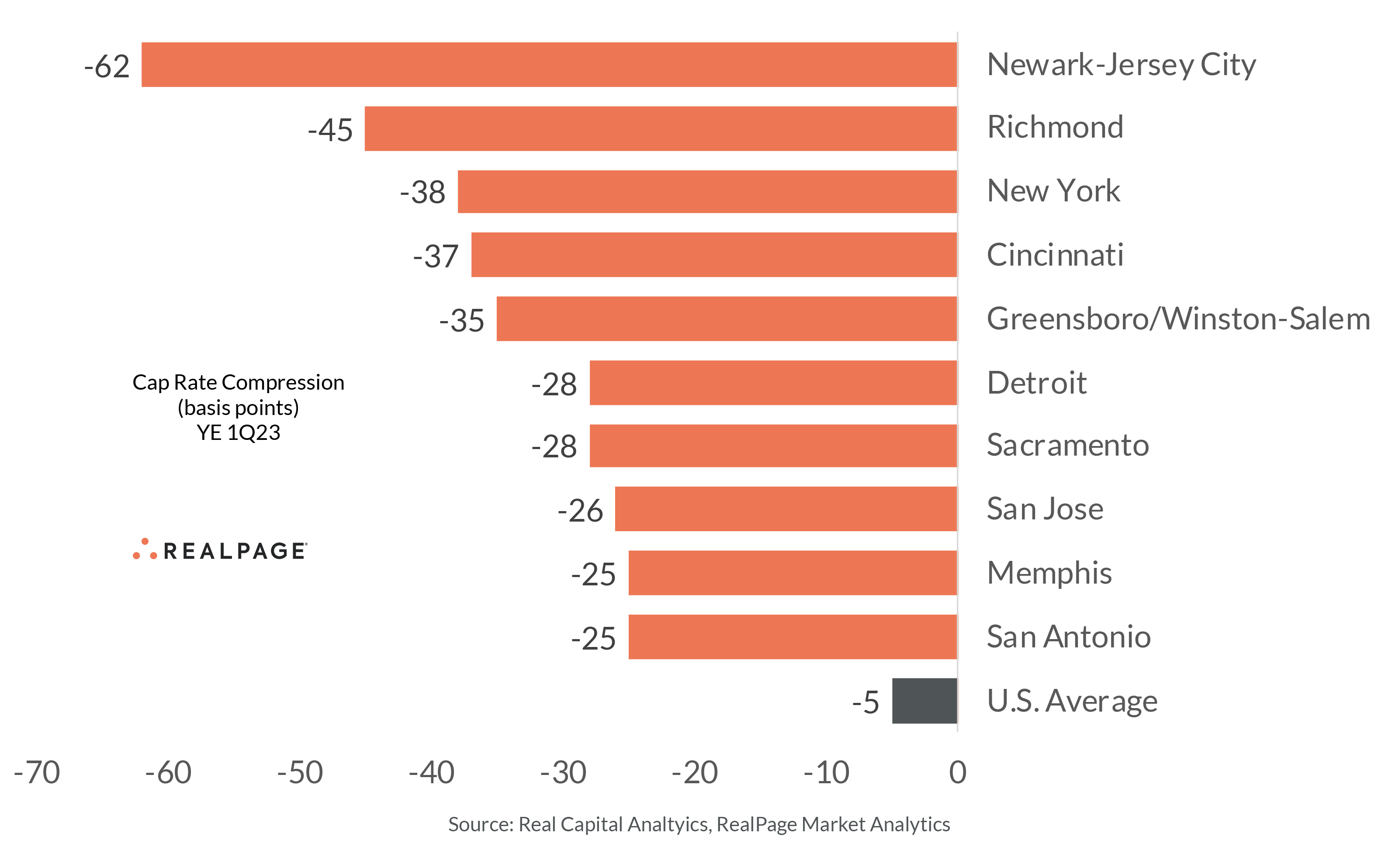

Deep Cap Rate Declines in Slow-and-Steady Markets | RealPage Analytics Blog – Source www.realpage.com

Demystifying Manhattan Cap Rates

Simply put, cap rates represent the annual rate of return on an investment property, calculated as net operating income (NOI) divided by the property’s current market value. They offer a glimpse into the property’s earning potential, helping investors assess its viability and make informed decisions.

Comprehensive Analysis Of Black Data By Quarter, Yearly Trends Unveiled – Source slidesdocs.com

Historical Evolution and Unraveling the Myths

Manhattan cap rates have exhibited fascinating fluctuations over time, influenced by economic cycles, market trends, and investor sentiment. Unraveling the myths surrounding cap rates is crucial. Some believe they are static or easily predictable, while others fear they are too volatile to be relied upon. The truth lies somewhere in between.

Cap Rates Notes – Prof. Todd Sinai, Fall 2021 – Cap Rate = NOI/V Cap – Source www.studocu.com

Unveiling the Hidden Secrets

Beyond the surface lies a treasure trove of hidden secrets related to Manhattan cap rates. These include understanding the impact of property type, location, building age, and rental income on cap rates. It’s essential to look beyond the headline number and delve into these nuances to make truly informed investment decisions.

MANHATTAN DRIVER CAP – Total Image Group – Source totalimagegroup.com.au

Recommendation: Harnessing Cap Rates for Success

No two Manhattan cap rates are created equal. Investors must meticulously research and analyze each property’s unique characteristics to determine its potential profitability. Using cap rates as a benchmark, you can compare different investment opportunities and identify those that align with your risk tolerance and financial goals.

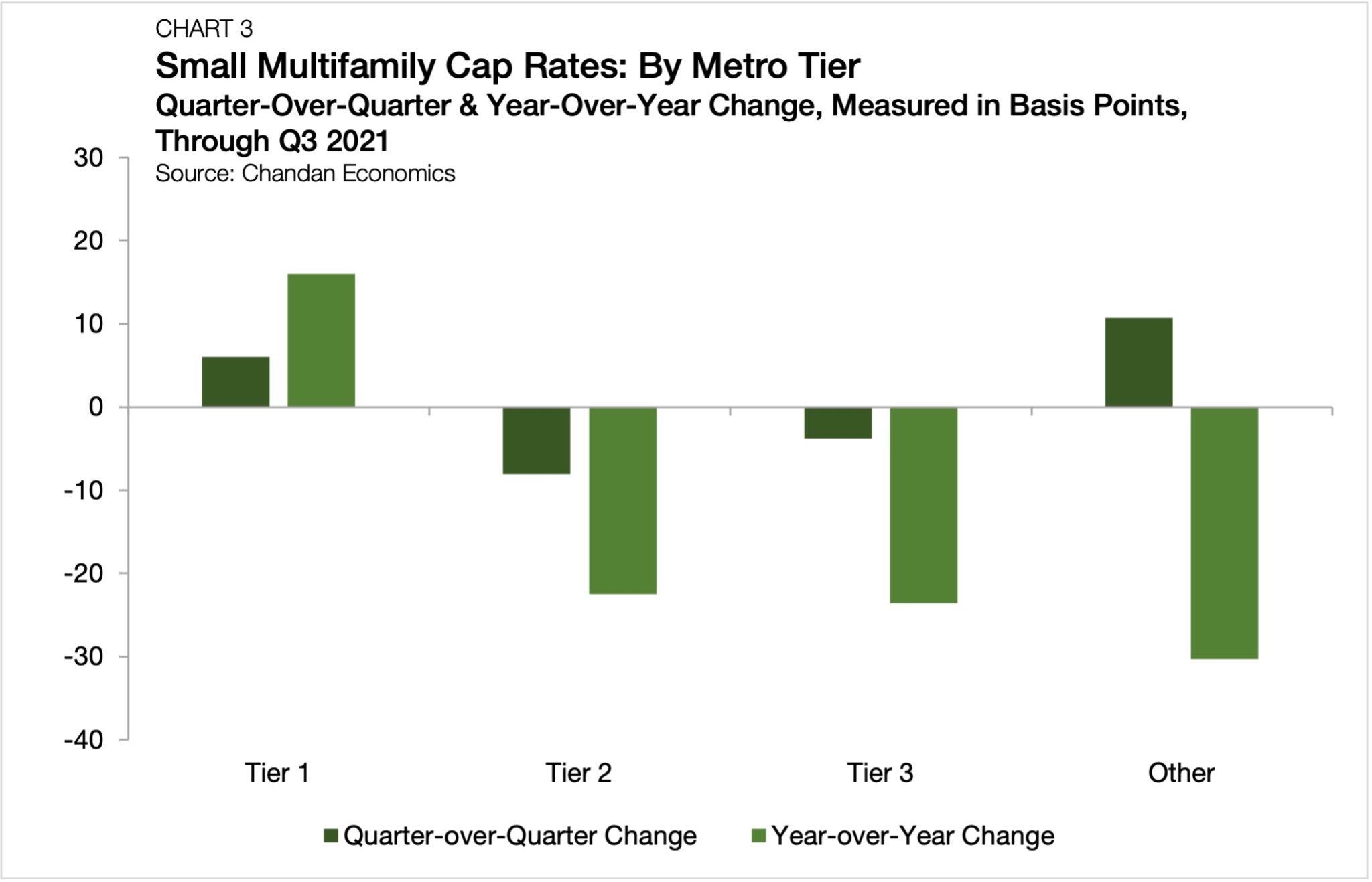

Q3 2021 Small Multifamily Metro Area Cap Rate Trends – Arbor Realty – Source arbor.com

Captivating Cap Rates: A Deeper Dive

Manhattan cap rates are a powerful tool for savvy investors. By understanding their intricacies, you can unlock an array of benefits, including:

– Accurate assessment of investment returns

– Informed decision-making in property selection

– Optimal leverage of market opportunities

Capitan Manhattan (Dr. Manhattan + Cap. Universe) by DresspeteeterArt – Source www.deviantart.com

Manhattan Cap Rates: Tips for Success

– Embark on thorough research and consult with experienced professionals.

– Seek personalized guidance to tailor cap rate analysis to specific investment goals.

– Stay abreast of market trends and economic indicators that influence cap rates.

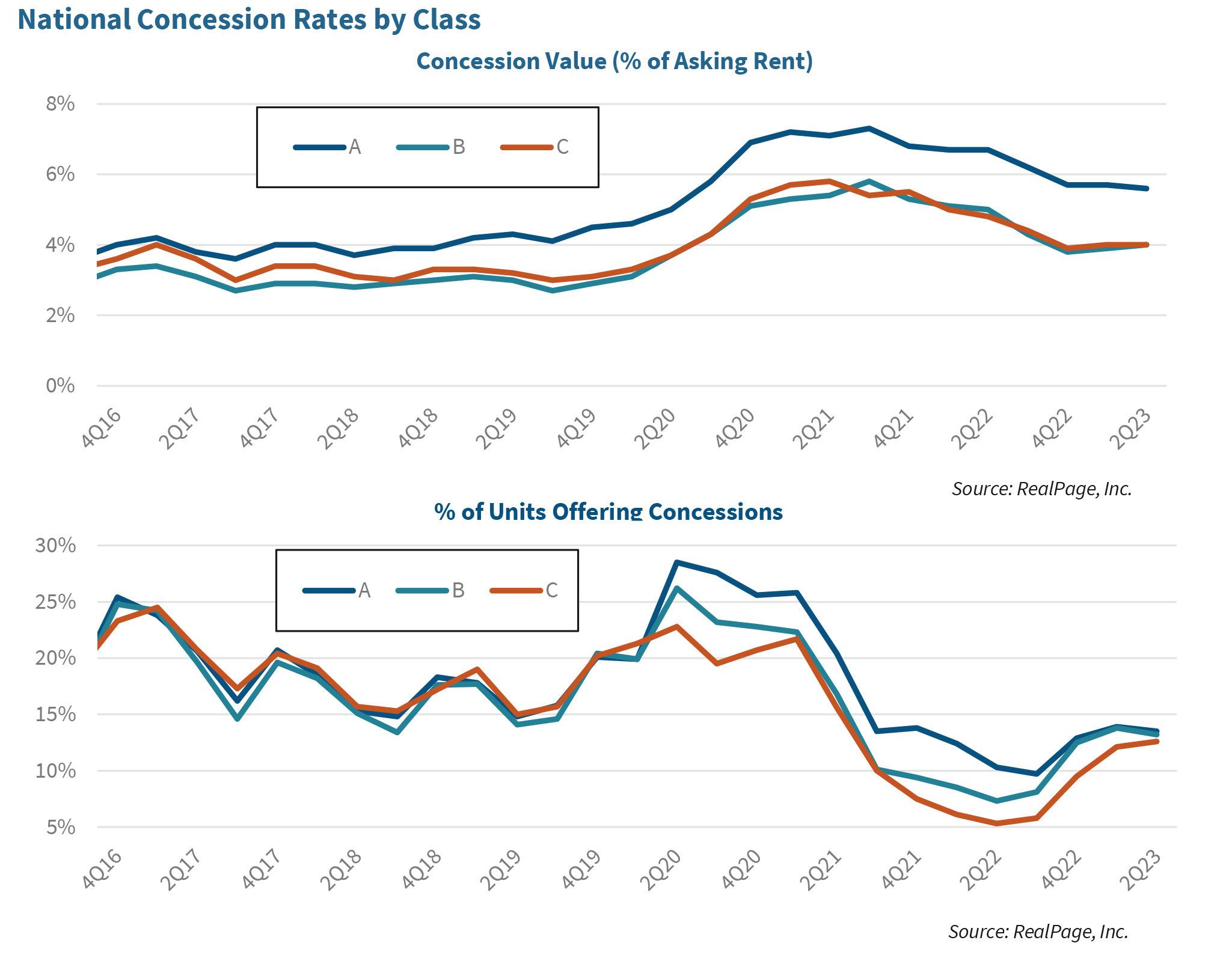

2023 Mid-Year Multifamily Market Outlook – Demand Subdued But Positive – Source multifamily.fanniemae.com

Captivating Cap Rates: Unlocking Investment Potential

Manhattan cap rates offer a wealth of insights into the city’s real estate market. From understanding the investment potential of different neighborhoods to making informed decisions about property purchases, cap rates are an indispensable tool for investors.

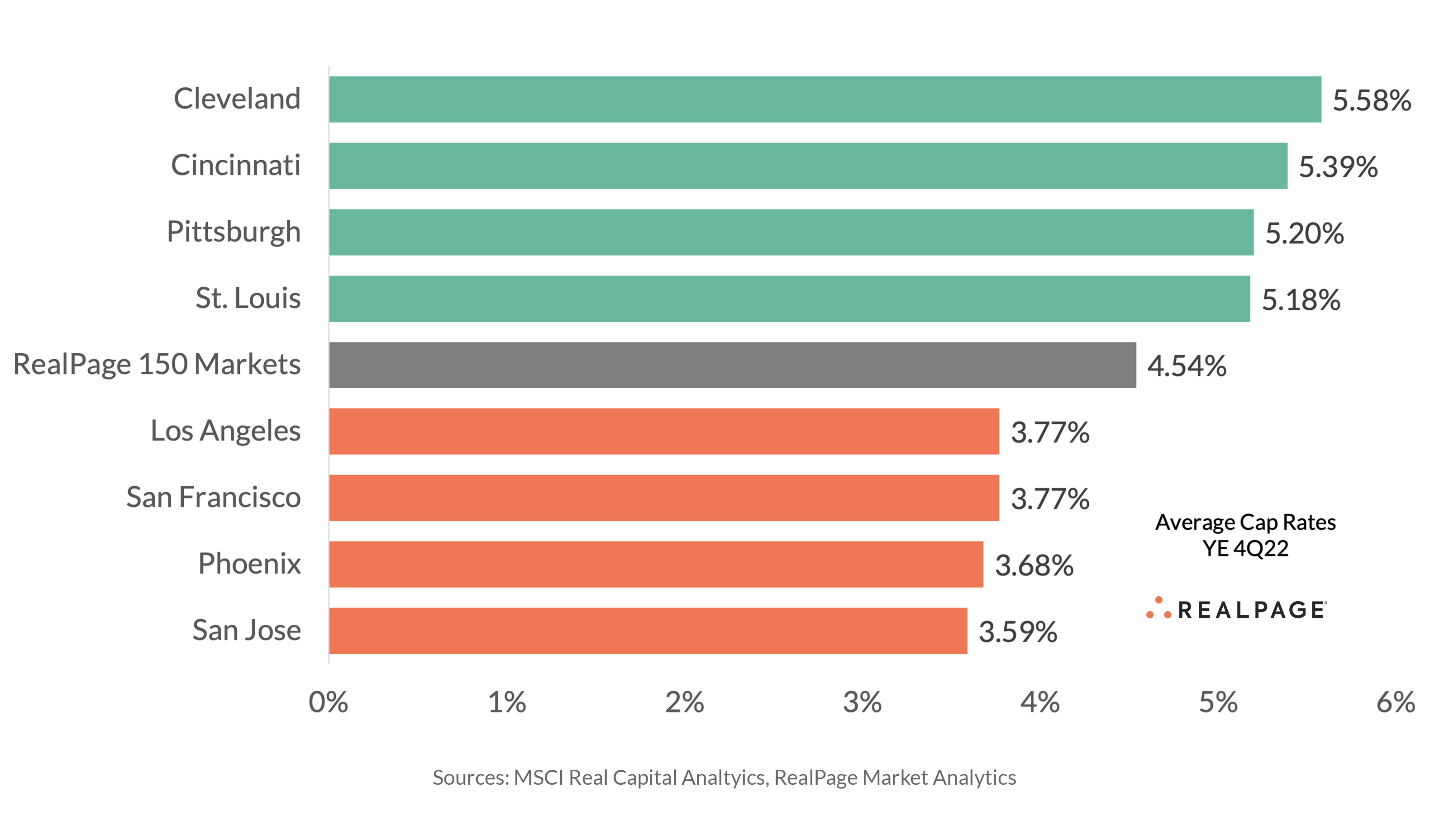

Midwest Markets Have Some of Nation’s Highest Cap Rates | RealPage – Source www.realpage.com

Manhattan Cap Rates: Fun Facts

– Cap rates can vary significantly within a single building, depending on factors such as floor number and unit size.

– Historical cap rate data can provide valuable insights into market trends and potential future fluctuations.

– Investors can negotiate cap rates with sellers during property transactions, creating opportunities for favorable deals.

Manhattan Cap Rates: The Path to Success

– Conduct thorough due diligence and market analysis before investing.

– Determine the property’s NOI accurately to ensure reliable cap rate calculations.

– Monitor cap rates over time to track market performance and adjust investment strategies accordingly.

Manhattan Cap Rates: A Comprehensive Q&A

– What is a good cap rate in Manhattan? It varies depending on property type and location, but typically falls between 3.5% and 5.5%.

– How do I calculate cap rate? Divide the property’s NOI by its current market value.

– What factors influence cap rates? Property type, location, building age, and rental income all play a role.

– Can I negotiate cap rates? Yes, it’s not uncommon for buyers and sellers to negotiate cap rates during property transactions.

Conclusion of Manhattan Cap Rates: A Comprehensive Analysis

Manhattan cap rates are a complex yet essential aspect of investing in the city’s real estate market. By understanding their intricacies, investors can unlock a wealth of insights, enabling them to make informed decisions, maximize returns, and achieve long-term success.