Unlocking Value and Resilience: A Guide to Industrial Property Investment

Unlocking the hidden value and resilience of industrial property investments requires a comprehensive understanding of the market, its opportunities, and potential pitfalls. This guide provides a deep dive into the key considerations for successful industrial property investments.

Unlocking the Value of Energy Resilience | EnTech Solutions – Source energybyentech.com

Pain Points in Industrial Property Investing

Investors seeking stability and growth in industrial property face various challenges. Volatile market conditions, rising land costs, and shifting supply chains can create uncertainty and impact returns. Understanding these pain points is crucial for developing effective investment strategies.

Unlocking Real Estate Property Appraisals A Guide – Source nolvamedblog.com

Target Audience of This Guide

This guide is designed for investors, property professionals, and anyone seeking to maximize returns in the industrial property sector. It provides practical advice, industry insights, and best practices to help investors navigate the complexities of the market and make informed decisions.

Investing in your resilience | Amazing If – Source www.amazingif.com

Summary of Main Points

This guide explores the following key points:

– Understanding the industrial property market dynamics

– Identifying opportunities and assessing risks

– Maximizing returns through value-added strategies

– Staying informed and adapting to industry trends

Investing in resilience | CiC Wellbeing Blog – Source www.cicwellbeing.com

Unlocking Value: A Personal Experience

My initial venture into industrial property investment was met with skepticism. However, thorough market research, understanding of tenant profiles, and a focus on value-add strategies helped me secure a stable and lucrative asset. The key lies in identifying undervalued properties with potential for growth.

How PARC’s Seniors Are Becoming Stronger and More Resilient – PARC – Source parcliving.ca

What is Value and Resilience?

Value refers to the intrinsic worth of a property, considering factors such as location, infrastructure, accessibility, and building quality. Resilience denotes an asset’s ability to withstand market fluctuations and generate consistent returns. By investing in industrial properties with high value and resilience, investors can mitigate risks and maximize long-term gains.

Daniel Fusco: Unlocking Resilience When Life is a Mess – Barb Raveling – Source barbraveling.com

History and Myths

Industrial property investment has a long history, dating back to the industrial revolution. Over time, certain myths have emerged, such as the belief that industrial properties are only suitable for large-scale manufacturing. However, the sector has evolved, and today, industrial properties cater to a wide range of businesses, including logistics, distribution, and e-commerce.

How to Improve Your Organization’s Cyber Resiliency | CIO – Source www.cio.com

Hidden Secrets

Unveiling the hidden secrets of industrial property investment involves recognizing industry trends. The rise of e-commerce, automation, and supply chain optimization has led to increased demand for industrial space. By staying attuned to these trends, investors can identify emerging opportunities and capitalize on them before they become widely known.

9 Ways to Build Resilience and Grit | You Are A Success – Life Coaching – Source youaresuccesslifecoach.com

Recommendations

To achieve success in industrial property investment, consider these recommendations:

– Conduct thorough due diligence before acquiring any property.

– Identify tenants with strong financial stability and long-term lease commitments.

– Seek expert advice from industry professionals, including brokers, property managers, and lawyers.

– Monitor market conditions and industry trends regularly to adjust strategies accordingly.

– Consider value-add strategies such as property renovations or expansions to enhance return on investment.

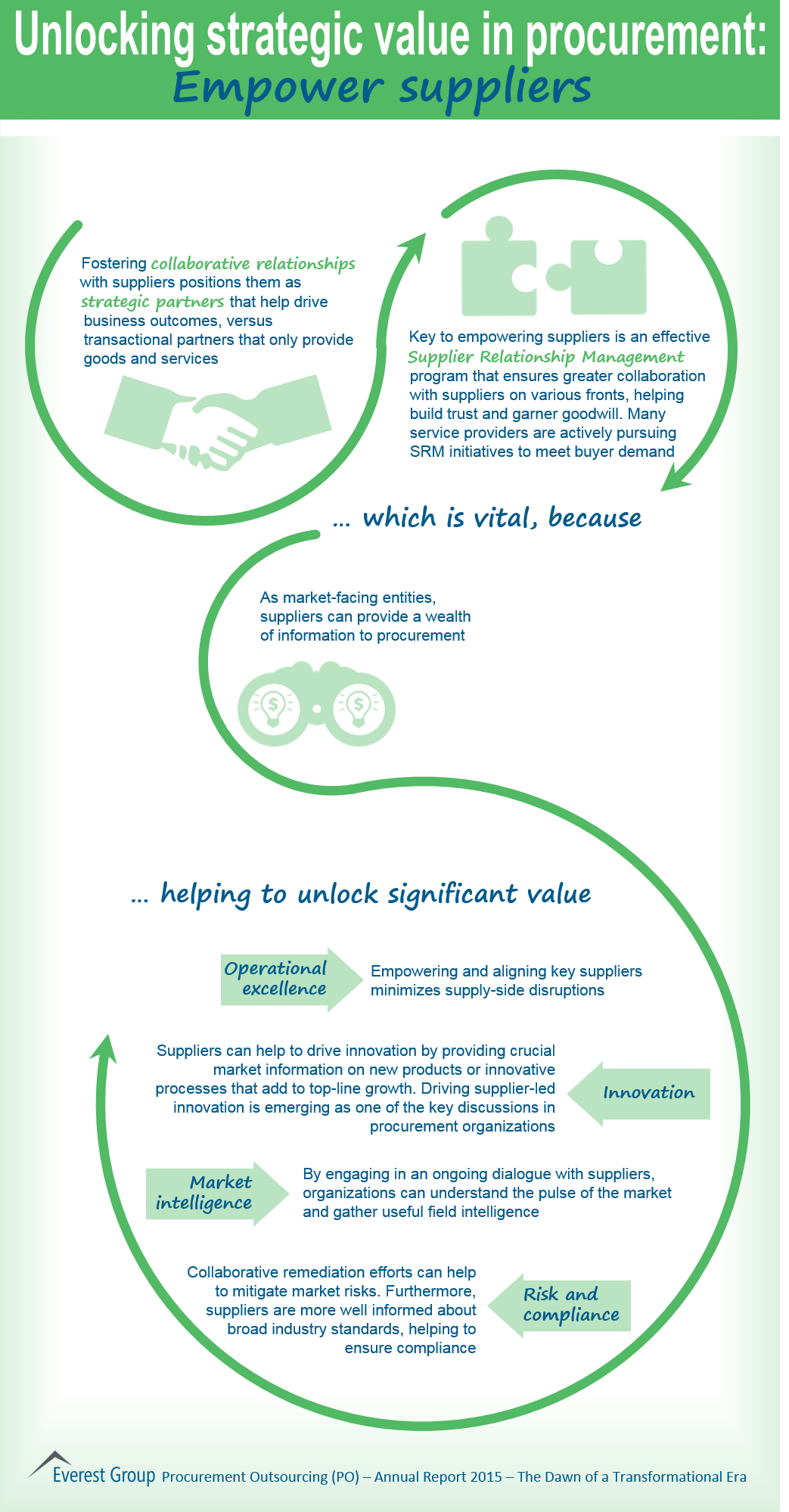

Unlocking Srategic Value in Procurement | Market Insights™ – Everest Group – Source www.everestgrp.com

Location Matters

Location is a crucial factor in industrial property investment. Properties in strategic locations with good transportation access, proximity to major markets, and a skilled workforce tend to command higher rents and experience lower vacancy rates. Investors should carefully evaluate the location of potential properties before committing.

Resilience 101 – What Is Resilience And Why You Need It – Source stevejoynson.com

Tips for Investors

To maximize returns, investors should consider the following tips:

– Diversify portfolio by acquiring properties in different markets and property types.

– Implement active asset management strategies to maintain high occupancy rates and minimize operating expenses.

– Seek out opportunities for value creation through redevelopment or expansion of properties.

– Partner with experienced property managers to handle day-to-day operations and maximize rental income.

Tenant Profile

Understanding the tenant profile of a property is essential. Long-term leases with financially stable tenants provide stability and minimize vacancy risk. Investors should thoroughly screen potential tenants, including evaluating their financial condition, industry experience, and lease history.

Fun Facts

Industrial property investment can be a fascinating and rewarding endeavor. Here are some fun facts to consider:

– The global industrial property market size is expected to reach $1.3 trillion by 2026.

– E-commerce has significantly increased demand for industrial space, particularly for warehouses and distribution centers.

– Industrial properties often benefit from tax incentives and government support due to their role in job creation and economic growth.

How to Invest

To invest in industrial property, investors typically follow these steps:

– Identify a target market and property type.

– Conduct thorough due diligence, including site visits and financial analysis.

– Secure financing and negotiate purchase terms.

– Manage the property through ongoing maintenance and tenant relations.

– Track performance and adjust strategies as needed.

What if Scenarios

Investors should consider various “what if” scenarios to prepare for potential challenges. For instance, they should assess the impact of changing market conditions, tenant turnover, and unexpected expenses. Developing contingency plans and having access to capital can help mitigate risks and ensure the sustainability of investments.

Listicle: Benefits

Industrial property investment offers numerous benefits, including:

– Stable and predictable rental income.

– Long-term lease agreements with established tenants.

– Potential for capital appreciation through value-add strategies.

– Diversification benefits within real estate portfolios.

– Tax incentives and government support.

Questions and Answers

Here are some common questions and answers about industrial property investment:

– Q: What are the key factors to consider when selecting an industrial property?

– A: Location, building quality, tenant profile, and potential for value creation.

– Q: How can I minimize risks in industrial property investment?

– A: Conduct thorough due diligence, diversify portfolio, and secure long-term leases with financially stable tenants.

– Q: What are the potential returns on industrial property investment?

– A: Returns can vary depending on market conditions, property type, and management strategies. However, industrial properties typically offer stable and predictable income.

– Q: What is the role of a property manager in industrial property investment?

– A: Property managers handle day-to-day operations, including tenant relations, rent collection, and maintenance. They help maximize income and reduce expenses.

Conclusion of Unlocking Value And Resilience: A Comprehensive Guide To Investing In Industrial Property

Unlocking value and resilience in industrial property investment requires a comprehensive understanding of market dynamics, value-add strategies, and potential risks. By following the insights and recommendations outlined in this guide, investors can navigate the complexities of the sector and position their investments for long-term success.