Navigating the complexities of commercial real estate as an investor or developer can be a daunting task. To succeed in this competitive market, understanding the diverse property types and their unique characteristics is essential.

Investors and developers often face the challenge of identifying the right property type to align with their investment goals. The vast array of commercial real estate options can be overwhelming, making it crucial to grasp the key distinctions among them.

This comprehensive guide is designed to empower investors and developers with the knowledge they need to make informed decisions when selecting commercial real estate properties. We will delve into the different property types, exploring their unique features, advantages, and considerations.

Understanding Property Types for Commercial Real Estate

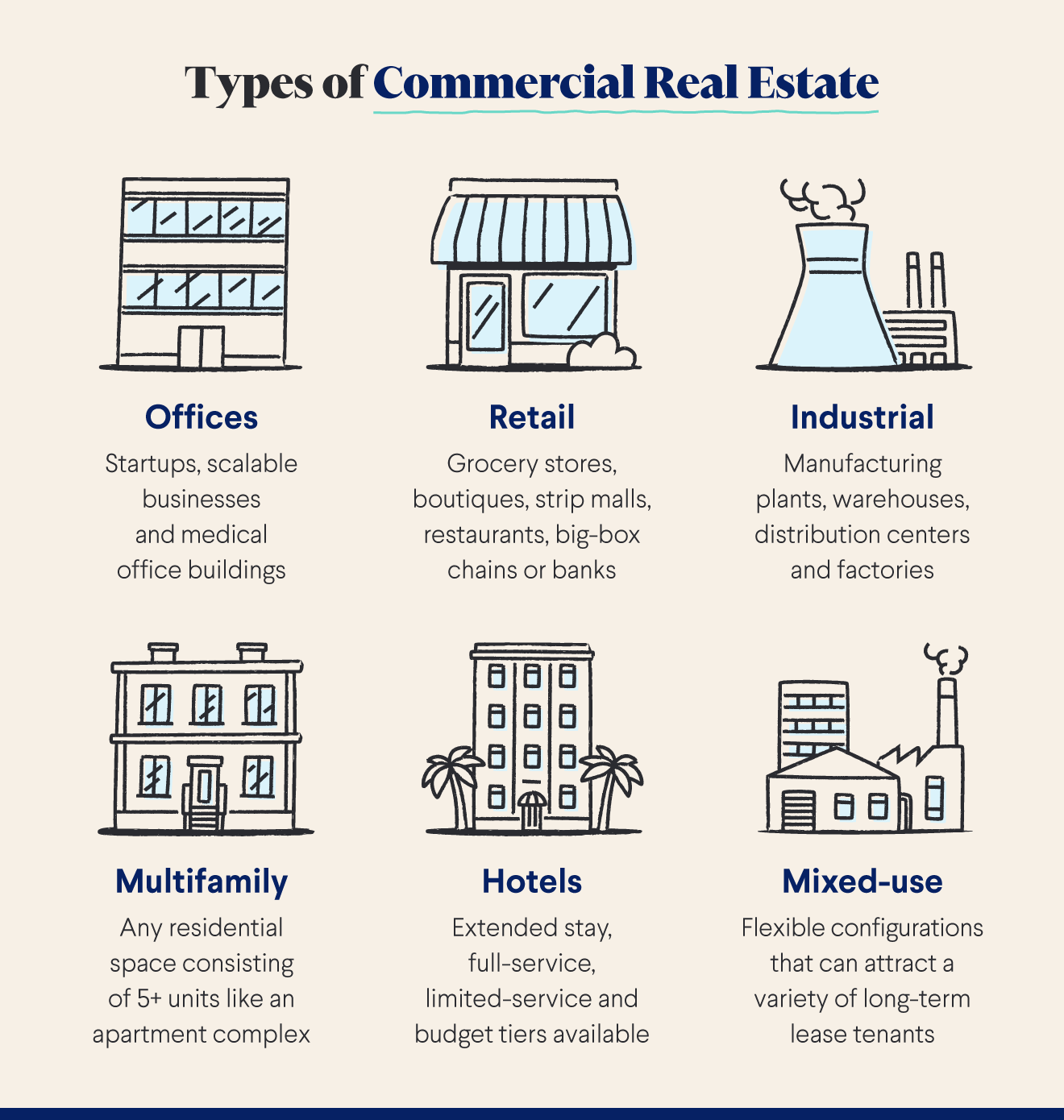

Commercial real estate encompasses a wide range of property types tailored to specific business needs and investor preferences. Each type offers distinct characteristics that influence its value, cash flow potential, and investment returns. Understanding these property types is vital for making strategic investment decisions.

Retail – Source www.crowdengine.com

Office Buildings

Office buildings are designed to accommodate businesses and organizations of various sizes. They typically feature multiple floors with individual offices, shared workspaces, and common areas. Office buildings provide a professional environment for businesses and can offer stable rental income for investors. They are commonly found in urban areas and central business districts.

Commercial Properties Near Me: Why Invest in Commercial Property – Source chucksplaceonb.com

Retail Properties

Retail properties encompass spaces used for selling goods and services to consumers. They include shopping malls, retail stores, strip malls, and big-box stores. Retail properties rely on foot traffic and accessibility to attract customers. They offer high visibility and the potential for significant rental income, but can also be subject to fluctuations in consumer spending.

a man using digital tablet, and modern buildings hologram. Real estate – Source westwoodnetlease.com

Industrial Properties

Industrial properties are designed for manufacturing, storage, and distribution operations. They typically include warehouses, distribution centers, and factories. Industrial properties require ample space and accessibility for heavy equipment and goods movement. They offer the potential for long-term leases and stable rental income, but may require specialized infrastructure and maintenance.

Commercial Real Estate 101: How to Buy Property – Source www.weareaugustines.com

Multifamily Properties

Multifamily properties consist of residential units with shared common areas. They include apartment buildings, townhouses, and condominiums. Multifamily properties provide stable rental income and can benefit from long-term tenant relationships. They are often found in urban and suburban areas with high demand for housing.

How to Start a Rental Property Business: 11 Easy Tips for Beginners – Source moneydoneright.com

The Significance of Property Type Diversification

Diversifying your commercial real estate portfolio across different property types can help mitigate risk and enhance returns. By investing in a mix of office, retail, industrial, and multifamily properties, you can balance the strengths and weaknesses of each type. This approach provides a more stable and resilient investment strategy.

Why Having A Tenant Representative Is Key To Finding The Best Office – Source www.botsfordlibrary.org

Tips for Selecting the Right Property Type

When selecting a commercial real estate property, consider the following factors:

- Investment goals: Identify your desired return profile, risk tolerance, and investment horizon.

- Market analysis: Research the local market dynamics, including supply and demand, rental rates, and economic conditions.

- Property type alignment: Choose a property type that aligns with your investment goals and market conditions.

- Due diligence: Perform thorough due diligence on the property, including physical inspections, financial analysis, and legal review.

Property investors- Top tips to grow your property portfolio – Source valorproperties.co.uk

Common Pitfalls in Commercial Real Estate Investment

Avoid these common pitfalls to maximize your chances of success in commercial real estate investing:

- Overpaying for a property: Conduct thorough research to determine the fair market value and avoid overpaying.

- Ignoring due diligence: Skimping on due diligence can lead to hidden problems and financial losses.

- Inadequate cash flow: Ensure that the property generates sufficient cash flow to cover operating expenses and debt payments.

- Lack of diversification: Concentrating your investments in a single property type or location can increase risk.

Commercial Real Estate Property Types – CrowdEngine – Source crowdengine.com

Fun Facts About Commercial Real Estate

Did you know that:

- The world’s tallest building, the Burj Khalifa, is used primarily for commercial purposes.

- The largest shopping mall in the United States, the Mall of America, spans over 5 million square feet.

- Industrial real estate accounts for over 20% of the total commercial real estate market.

23 Different Property Types: Real Estate Guide – Source uphomes.com

How to Get Started

If you’re ready to explore commercial real estate, follow these steps:

- Define your investment goals and strategy: Determine your financial objectives and risk appetite.

- Research and analyze the market: Gather data on various property types, market trends, and demographics.

- Identify potential properties: Use online platforms, brokers, and networking to find suitable properties.

- Conduct due diligence: Hire professionals to assess the property’s physical condition, financial performance, and legal compliance.

Uncover the World of Real Estate: Discover Its Diverse Types and Unlock – Source edaigouek.info

What if It Doesn’t Work Out?

Despite careful planning, sometimes commercial real estate investments don’t pan out as expected. Here are some tips for managing setbacks:

- Re-evaluate the market: Conduct a thorough market analysis to identify changes that may have affected the property’s performance.

- Consider refinancing options: Explore refinancing the property to reduce interest rates or extend the loan term.

- Sell the property: If necessary, consider selling the property to recoup as much of your investment as possible.

Listicle: 5 Critical Factors for Commercial Real Estate Success

- Location: Choose a property in a desirable location with high visibility and accessibility.

- Tenant quality: Secure reliable tenants with a history of stable payments and long-term leases.

- Property condition: Maintain the property in good condition to attract tenants and maximize rental income.

- Market research: Stay informed about market trends, economic indicators, and changes in tenant demand.

- Professional advice: Work with experienced professionals, such as real estate agents, brokers, and lawyers, to guide you through the process.

Questions and Answers

Q: How do I determine the value of a commercial property?

A: Property valuation is complex and involves factors such as location, size, condition, and market demand. Hire a qualified appraiser to provide an accurate assessment.

Q: What are the common lease terms in commercial real estate?

A: Common lease terms include length, rent amount, operating expenses, renewal options, and termination clauses. Carefully review and understand the lease terms before signing.

Q: How do I handle tenant disputes?

A: Address tenant disputes promptly and communicate clearly. Seek legal advice if necessary to protect your rights and resolve issues effectively.

Q: What are the tax implications of commercial real estate investment?

A: Consult a tax professional to understand the tax implications, benefits, and deductions related to commercial real estate ownership.

Conclusion of Guide To Commercial Real Estate Property Types For Investors And Developers

Making informed decisions in commercial real estate requires a deep understanding of the diverse property types available. By carefully considering the unique characteristics, advantages, and considerations of each type, investors and developers can align their investments with their goals and maximize returns. Remember, thorough research, due diligence, and consultation with professionals are key to success in this dynamic market.