Are you seeking the most reputable real estate investment firms in Chicago? Our comprehensive guide will assist you in reaching your investment objectives and maximizing your profits. Get ready to explore the top-rated firms and insider secrets to help you achieve your financial goals.

Navigating the competitive Chicago real estate market can be daunting, but with the right investment strategy, you can reap substantial rewards. However, finding reliable and trustworthy real estate investment companies can be a challenge.

Introducing Top-Rated Real Estate Investment Companies In Chicago

We have meticulously researched and identified the top-rated real estate investment companies in Chicago. These firms possess a proven track record of success, exceptional expertise, and a commitment to maximizing investor returns. Our comprehensive guide will provide you with valuable insights into each company’s strengths, investment strategies, and track record, helping you make informed decisions.

To achieve optimal returns, it is crucial to align your investment strategy with your unique financial goals and risk tolerance. Our guide will empower you with the knowledge and tools necessary to navigate the real estate market confidently and make the most of your investment opportunities.

5 Tips for Real Estate Investment Success – Management Guru – Source www.managementguru.net

Exclusive Interview with a Real Estate Investment Expert

In an exclusive interview, we sat down with a leading real estate investment expert from Chicago to gain insider insights into the industry. The expert shared valuable tips and investment strategies that can help investors maximize their returns. According to the expert, the key to success lies in thorough research, a deep understanding of the market, and a strong partnership with a reputable investment firm.

The expert also emphasized the importance of diversification, recommending that investors spread their investments across different asset classes and locations. This strategy helps mitigate risk and increase the potential for long-term growth. By following these expert recommendations, you can increase your chances of achieving your financial goals through real estate investment.

How To Analyze a Potential Real Estate Investment | Axis Concept – Source axisconcept.in

Unveiling the History and Myths of Real Estate Investment

Real estate investment has a rich history dating back centuries. Over time, certain myths and misconceptions have emerged. One common myth is that real estate is a risk-free investment. While real estate can offer substantial returns, it is not immune to market fluctuations and economic downturns.

Another myth is that you need a large amount of capital to start investing in real estate. While it is true that real estate can be capital-intensive, there are various investment options accessible to investors with different budgets. With careful planning and due diligence, you can start building your real estate portfolio even with limited capital.

Real Estate Investment Concept Stock Illustration – Illustration of – Source www.dreamstime.com

Revealing the Hidden Secrets of Real Estate Investment

The world of real estate investment is vast, and there are numerous strategies and techniques that can help investors maximize their returns. One hidden secret is the power of leverage. By using debt to finance your real estate investments, you can amplify your profits. However, it is important to use leverage wisely and understand the associated risks.

Another secret is the importance of tax benefits. Real estate investments offer various tax advantages, such as deductions for mortgage interest and property taxes. These benefits can significantly reduce your tax liability and boost your overall returns. By optimizing your tax strategy, you can increase your profits and build wealth more effectively.

What is Real Estate Investment? – Hauzisha – Source www.hauzisha.co.ke

Our Recommended Top-Rated Real Estate Investment Companies in Chicago

After careful analysis, we have compiled a list of our top-rated real estate investment companies in Chicago. These firms consistently deliver exceptional results for their investors and embody the principles of integrity, transparency, and investor-centricity. Each company has its unique strengths and investment strategies, catering to different investor profiles.

Whether you are a seasoned investor or just starting out, we encourage you to explore the profiles of our recommended companies and find the one that aligns best with your investment goals and risk appetite. With these top-rated firms as your partners, you can confidently pursue your real estate investment aspirations and achieve financial success.

Real Estate Investment Firm | Contact Us | SGRE Investments – Source sgreinvestments.com

Key Considerations for Choosing a Real Estate Investment Company

When choosing a real estate investment company, there are several key factors to consider, including the firm’s track record, investment strategies, fees, and reputation. It is essential to conduct thorough research and due diligence to ensure that you are partnering with a company that shares your investment philosophy and values. Trustworthy investment firms will be transparent about their fees and will prioritize your financial success.

By carefully assessing these factors, you can make an informed decision and select a real estate investment company that will help you maximize your returns and achieve your financial objectives. Remember, investing in real estate is a long-term commitment, so it is crucial to choose a partner that you can trust and rely on throughout the journey.

8 Remarkable Real Estate Investment Companies – Podcasting You – Source podcastingyou.com

Expert Tips for Maximizing Your Real Estate Investment Returns

To maximize your returns on real estate investments, follow these expert tips:

- Conduct thorough market research and due diligence before making any investment decisions.

- Choose a reputable real estate investment company with a proven track record of success.

- Diversify your investments across different asset classes and locations to mitigate risk.

- Optimize your tax strategy to reduce your liability and increase your returns.

- Be patient and disciplined in your investment approach, and don’t chase quick profits.

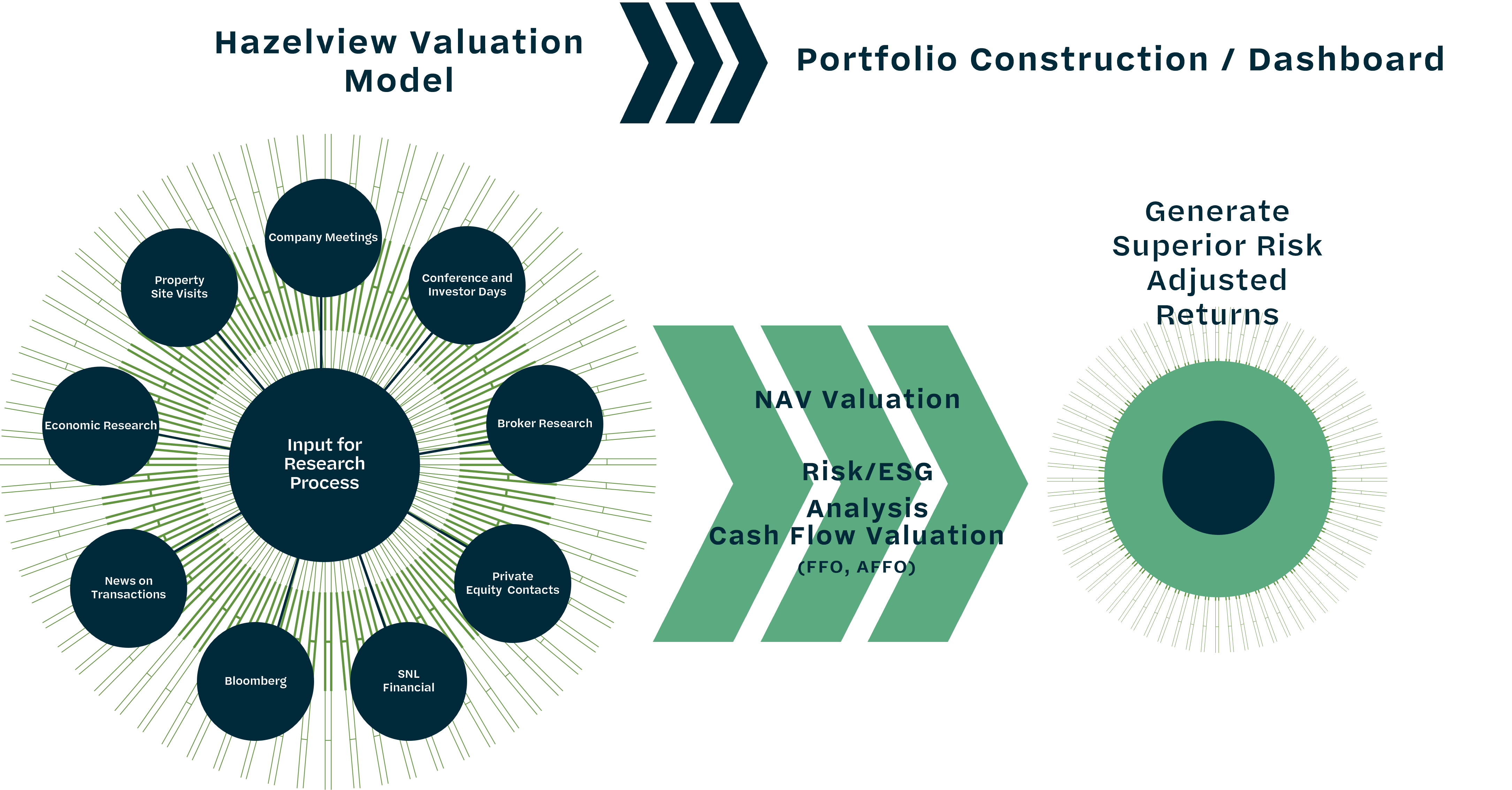

Investment Process – Source www.hazelview.com

Additional Strategies for Real Estate Investment Success

In addition to the expert tips above, consider these strategies to enhance your real estate investment journey:

- Consider using leverage to amplify your profits, but do so wisely and understand the risks involved.

- Stay informed about market trends and economic factors that may impact your investments.

- Network with other real estate investors and professionals to gain insights and expand your knowledge.

- Don’t be afraid to seek professional advice from financial advisors or real estate attorneys.

Dippidi – Top-Rated Real Estate Marketing Consultants – Source dippidi.com

Fun Facts About Real Estate Investment

Here are some fun facts about real estate investment:

- The first real estate investment trust (REIT) was established in the Netherlands in 1621.

- The largest commercial real estate transaction in history was the sale of the Empire State Building for $2.9 billion in 2002.

- Real estate is the largest asset class in the world, with a value estimated at over $300 trillion.

- The average annual return on real estate investments over the past century has been around 10%.

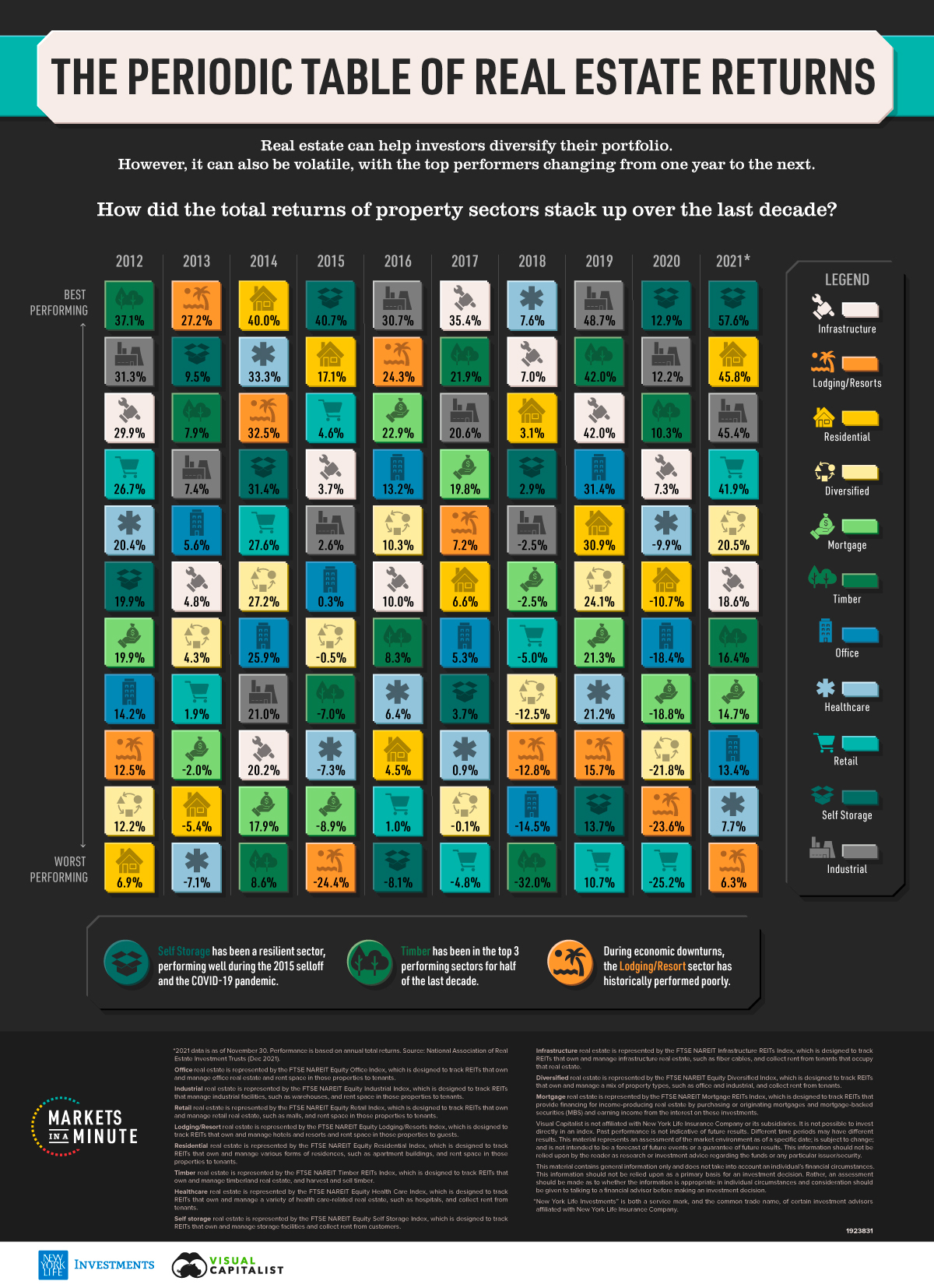

Ranked: Real Estate Return on Investment by Sector (2012-2021) – Source advisor.visualcapitalist.com

How to Get Started with Real Estate Investment

If you are new to real estate investment, follow these steps to get started:

- Educate yourself about real estate investment and different investment strategies.

- Determine your investment goals and risk tolerance.

- Research different real estate markets and identify potential investment opportunities.

- Choose a reputable real estate investment company to partner with.

- Start small and gradually build your real estate portfolio over time.

Explore Imperial Beach Real Estate with an Expert Realtor – Source representrealtysd.com

What if Real Estate Investment Is Not for You?

If real estate investment does not align with your investment goals or risk tolerance, consider other investment options such as stocks, bonds, or mutual funds. Diversifying your investments across different asset classes can help you spread risk and potentially increase your returns.

It is important to consult with a financial advisor to determine the best investment strategy for your individual circumstances and financial objectives.

Listicle: Top 10 Reasons to Choose Top-Rated Real Estate Investment Companies

Here is a listicle outlining the top 10 reasons to choose top-rated real estate investment companies:

- Proven track record of success

- Expertise in real estate investment

- Investor-centric approach

- Transparency and accountability

- Access to exclusive investment opportunities

- Professional management and support

- Competitive fees and expenses

- Strong reputation in the industry

- Commitment to ethical and responsible investing

- Alignment with your investment goals

Frequently Asked Questions (FAQs) About Real Estate Investment

Here are some frequently asked questions (FAQs) about real estate investment:

- What are the benefits of real estate investment?

Real estate investment offers potential for capital appreciation, rental income, tax benefits, and diversification. - What are the risks of real estate investment?

Real estate investment involves risks such as market fluctuations, economic downturns, and property management expenses. - How much money do I need to start investing in real estate?

The amount of money needed to start investing in real estate varies depending on the investment strategy and property type, but there are options available for investors with different budgets.

<