Navigating the intricacies of commercial real estate investments can be a daunting task. Financial planning and investment analysis are crucial for making informed decisions, ensuring the profitability and success of your ventures. This comprehensive guide will delve into the essence of Commercial Real Estate Pro Forma, shedding light on its significance, components, and application in financial planning and investment analysis.

Uncertainties and complexities abound when embarking on commercial real estate projects. Accurately forecasting cash flows, expenses, and profitability can be a major challenge. The lack of a structured approach to financial planning and investment analysis can lead to missed opportunities, poor decision-making, and financial setbacks.

Pro Forma Model Template – Source data1.skinnyms.com

Comprehensive Commercial Real Estate Pro Forma: A Guiding Light

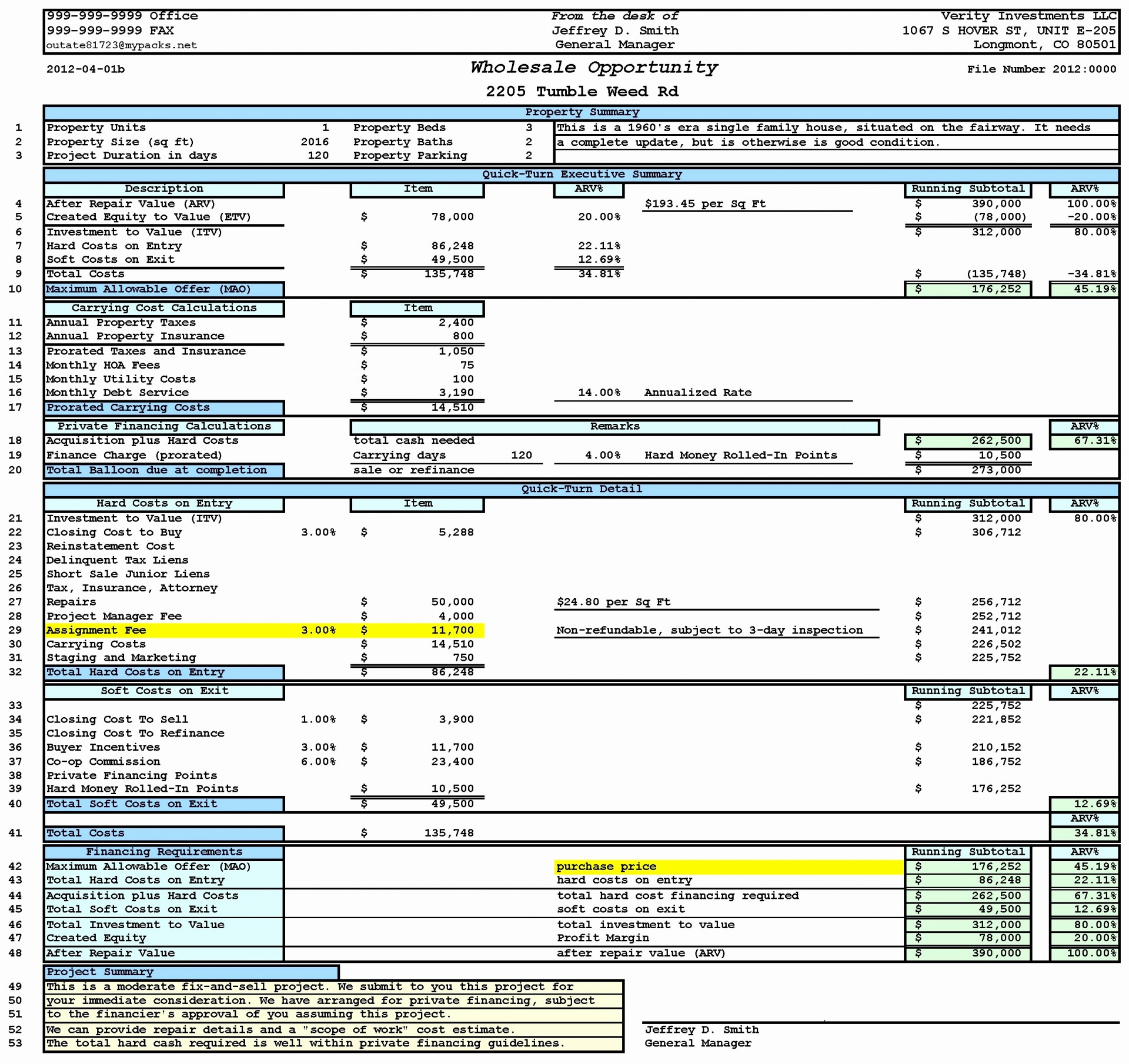

A Comprehensive Commercial Real Estate Pro Forma serves as a financial roadmap, providing a detailed projection of a property’s financial performance over a specified period. It encompasses various aspects, including income and expense projections, cash flow analysis, sensitivity analysis, and return on investment calculations. By incorporating historical data, market analysis, and assumptions, this tool empowers investors and analysts to make well-informed decisions and mitigate risks.

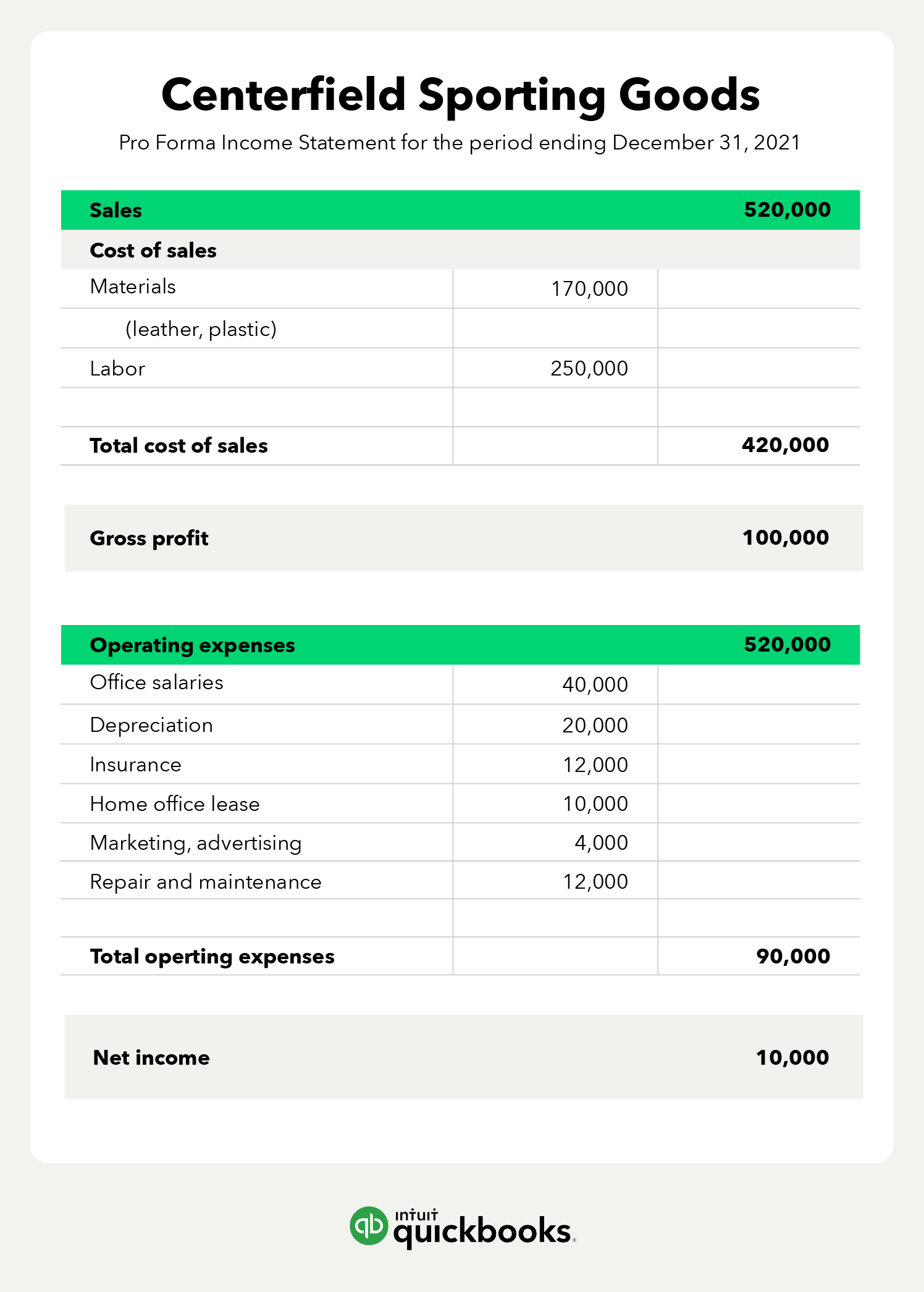

The main components of a Comprehensive Commercial Real Estate Pro Forma include:

- Income Statement: This section projects the property’s revenues, expenses, and net income over the forecast period.

- Balance Sheet: The balance sheet provides a snapshot of the property’s financial health at a specific point in time, outlining its assets, liabilities, and equity.

- Cash Flow Statement: This statement details the property’s cash inflows and outflows, providing insights into its liquidity and ability to meet financial obligations.

- Sensitivity Analysis: This analysis evaluates the impact of changes in key assumptions on the property’s financial performance.

- Return on Investment (ROI) Calculations: ROI calculations measure the profitability of the investment, providing a benchmark against which to compare alternative options.

Empowering Decisions with Commercial Real Estate Pro Forma

A Comprehensive Commercial Real Estate Pro Forma empowers investors and analysts to:

- Forecast Property Performance: Accurately predict revenue, expenses, and cash flow, enabling informed decision-making.

- Analyze Market Sensitivity: Assess the impact of market conditions and economic factors on the investment’s performance.

- Mitigate Financial Risks: Identify potential financial challenges and develop strategies to mitigate them.

- Compare Investment Options: Evaluate multiple commercial real estate opportunities and select the one with the highest potential for return.

The History and Myths Surrounding Commercial Real Estate Pro Forma

What Are Pro Forma Financial Statements? Examples & How to Create Them – Source blog.embarkwithus.com

Commercial Real Estate Pro Formas have evolved over time, reflecting changes in market dynamics and financial analysis techniques. However, several myths and misconceptions persist:

- Myth: Pro Formas are only useful for large-scale developments.

Truth: Pro Formas can be beneficial for projects of all sizes, providing valuable insights for both investors and developers. - Myth: Pro Formas are highly complex and difficult to understand.

Truth: While Pro Formas can be detailed, they are designed to be accessible and easy to interpret, enabling users to quickly grasp the financial implications of their investment. - Myth: Pro Formas are unreliable and subject to manipulation.

Truth: When prepared by qualified professionals and based on sound assumptions, Pro Formas provide a reliable foundation for decision-making. Regular review and updates help ensure accuracy and relevance.

Unveiling the Hidden Secrets of Commercial Real Estate Pro Forma

Beyond their practical applications, Comprehensive Commercial Real Estate Pro Formas conceal several hidden secrets:

- Hidden Assumption: Pro Formas rely on assumptions, which can significantly impact the projected financial performance. Understanding and validating these assumptions is crucial for accurate forecasting.

- Hidden Risks: Pro Formas may not fully capture all potential risks associated with a commercial real estate investment. Investors should conduct thorough due diligence and consider additional factors beyond those included in the Pro Forma.

- Hidden Value: Pro Formas can reveal hidden value in underperforming properties by identifying areas for improvement and strategic planning.

Recommendations for Effective Commercial Real Estate Pro Forma

To harness the full potential of Commercial Real Estate Pro Formas, follow these recommendations:

- Engage Qualified Professionals: Seek the expertise of experienced professionals, such as CPAs, financial analysts, or commercial real estate consultants, to prepare and review Pro Formas.

- Gather Comprehensive Data: Base Pro Formas on thorough market research, financial data, and industry benchmarks to ensure accuracy and reliability.

- Consider Multiple Scenarios: Develop Pro Formas under various market and economic conditions to assess potential risks and opportunities.

Real Estate Financial Modeling Excel Template – Source flamlabelthema.netlify.app

Importance of Assumptions in Commercial Real Estate Pro Forma

Assumptions play a critical role in Commercial Real Estate Pro Forma. These assumptions include factors such as rental rates, occupancy rates, operating expenses, and economic conditions. The accuracy of the Pro Forma heavily depends on the validity and reasonableness of these assumptions. It is crucial to challenge assumptions, conduct sensitivity analysis, and consider alternative scenarios to mitigate the impact of potential uncertainties.

Tips for Successful Implementation of Commercial Real Estate Pro Forma

To ensure the successful implementation of Commercial Real Estate Pro Formas, consider the following tips:

- Establish Clear Goals: Define the specific objectives and purposes of the Pro Forma before its development.

- Incorporate Market Analysis: Ground the Pro Forma in comprehensive market research and analysis to ensure alignment with industry trends and local market dynamics.

- Monitor and Update Regularly: Pro Formas should be reviewed and updated periodically to reflect changing market conditions and actual financial performance.

- Consider Tax Implications: Factor in relevant tax laws and regulations to accurately assess the financial implications of the investment.

Incorporating Sensitivity Analysis in Commercial Real Estate Pro Forma

Sensitivity analysis is a valuable tool in Commercial Real Estate Pro Forma. It involves evaluating the impact of changes in key assumptions on the projected financial performance. By adjusting assumptions such as rental rates, occupancy rates, and operating expenses, investors can assess the sensitivity of the investment to external factors and make informed decisions accordingly.

Benefits of Commercial Real Estate Pro Forma for Investors

Commercial Real Estate Pro Formas offer numerous benefits to investors, including:

- Enhanced Financial Planning: Pro Formas enable investors to plan their financial strategy effectively by providing detailed projections of cash flow, expenses, and profitability.

- Informed Investment Decisions: Pro Formas assist investors in making informed investment decisions by providing insights into the potential financial performance of a property.

Pro Forma Financial Statements Definition And Example – vrogue.co – Source www.vrogue.co

Fun Facts about Commercial Real Estate Pro Forma

Did you know these fun facts about Commercial Real Estate Pro Forma?

- The first Pro Formas were developed in the early 20th century to assess the financial viability of large-scale development projects.

- Pro Formas have become an indispensable tool for institutional investors, such as pension funds and insurance companies, to evaluate commercial real estate investments.

- Commercial Real Estate Pro Formas can be used to model different types of properties, including office buildings, retail centers, and industrial warehouses.

How to Create a Comprehensive Commercial Real Estate Pro Forma

Creating a Comprehensive Commercial Real Estate Pro Forma involves several steps:

- Gather Data: Collect relevant financial data, including historical performance, market analysis, and operating expenses.

- Develop Assumptions: Establish reasonable assumptions for key variables, such as rental rates, occupancy rates, and economic conditions.

- Build the Model: Construct the Pro Forma using a spreadsheet or software program, incorporating the gathered data and assumptions.

- Validate the Model: Review and validate the Pro Forma to ensure its accuracy and alignment with industry standards.

What if Analysis in Commercial Real Estate Pro Forma

The “what-if” analysis is a powerful feature of Commercial Real Estate Pro Forma. It allows investors to evaluate the impact of different scenarios on the projected financial performance. By adjusting assumptions and variables, investors can gain insights into the sensitivity of the investment to external factors and make informed decisions.

Listicle: 5 Essential Elements of Commercial Real Estate Pro Forma

- Income Statement: Projects revenue, expenses, and net income.

- Balance Sheet: Provides a snapshot of assets, liabilities, and equity.

- Cash Flow Statement: Details cash inflows and outflows.

- Sensitivity Analysis: Evaluates the impact of changes in assumptions.

- Return on

Real Estate Development Pro Forma Template Excel Template 1 Resume – Vrogue – Source www.vrogue.co